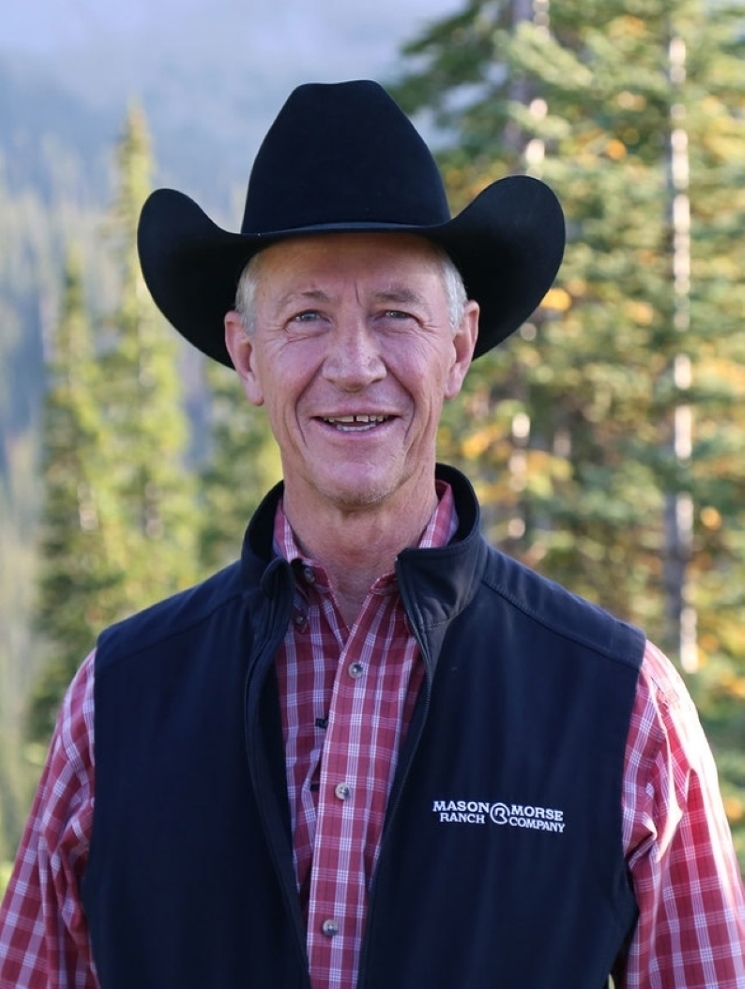

Land and Ranch Broker

Broker Associate and Partner

Mason & Morse Ranch Company

Top 3 Ways to Navigate Inflation in a Ranching Operation

The input costs of farming and ranching continue to increase as Inflation wreaks havoc on all of us. There are several ways to protect yourself and remain within your annual operating cashflow budget by managing both the revenue and expense side of the ledger. Insuring against losses due to natural causes is also beneficial to hold on until the cycle changes.

1. Increase Your Revenue by Selling More Pounds

With the cattle cycle entering a rebuilding stage, prices for the cow-calf and stocker operator are increasing. Increase your revenue by selling more pounds. Find efficient ways to hold on to your sale inventory longer to put more pounds on them. Hold off locking in your sale price as the upward market will enhance selling prices. Both practices will maximize revenue.

Another way to enhance revenue on a longer-term basis is through sustainable high intensity, short duration rotational grazing. These practices can increase forage production by as much as 30% to 50% over time. Ranching for Profit, Savory Institute and the NRCS are good resources for these practices.

2. Get Creative and Hold Costs Down

The highest costs in ranching revolve around feed production or loss of forage and grass on the ranch. Forage production and harvesting feed involves the greatest cost in livestock production.

A good way to hold cost down is to defer machinery replacement cost in the short term. Repairing haying equipment for a few more years rather than buying expensive new machinery is a way to defer costs until better economics arrive. As we move past the inflationary period, you will be able to trade for lower priced equipment.

Changing the mix of livestock for sale to reduce costs by retaining less replacement heifers can help reduce your cost structure and increase your revenue for a year or two, but long-term subjects you to having to purchase replacements. Certainly, this is not the most sustainable choice but heifer development costs impact the bottom line and deferring those costs to buy a cheaper replacement down the road can be considered.

Other factors that can impact the unit involve seeking part-time off-farm employment, adding another profit center to the labor staff and/or deferring the new truck purchase are creative ways to manage the bottom line.

3. Protect Against Losses with Insurance

While grass and forage grow naturally with some input cost, you can not afford the risk of drought or other natural weather events that limit or take your forage way. Often overlooked, insuring against that loss to protect against the cost of offsetting the forage loss with high priced feed.

Pasture, Rangeland and Forage (PRF) is a USDA subsidized crop insurance product available to ranchers and perennial hay growers that provides protection for a single peril – Lack of Precipitation. It is an area-based policy that uses NOAA data to pay indemnities when precipitation is below historical averages. PRF insurance is a precipitation-based policy that covers pasture, rangeland, or forage ground for perennial haying and grazing purposes.

The insurance product was designed to protect a producer’s operation from the risks of forage loss caused by a lack of precipitation. PRF is an area-based policy that uses the USDA grid system. Each grid is approximately 12 miles by 17 miles and uses weather data from NOAA’s Climate Prediction Center to determine rainfall indexes for coverage. PRF is an acre-based policy that has no upfront premium. There is a sales closing date of December 1st of each year.

The benefits of the program include Flexible coverage options, Insures grazing and haying ground, Available in 48 states, No upfront premiums and Offsets out of pocket costs caused by forage loss PRF insurance is available to all producers with an insurable interest. Producers are not required to insure all their acres, instead they can choose the acres most important to their operation. To qualify, you must select at least two 2-month intervals per year that do not overlap. Once the intervals are determined, a coverage level is then selected in 5% increments between 70-90%. Plans are further customized by choosing productivity factors ranging from 60-150%.

Summary

At the end of the day, a livestock rancher must balance productivity, sustainability and profitability to survive. These factors are inter-related and finding the optimal approach may require consultation with professional consultants.

About the Author

Since 1959, John Stratman has lived and worked on ranches in Colorado, Montana and Arizona and has owned and operated a ranch in eastern Colorado raising registered Red Angus seedstock and Quarter Horses. Professionally, John spent 18 years with MetLife’s Agricultural Investment Department, where he held various positions from Field Representative to Regional Manager. In addition to making agriculture real estate loans, investment activities included purchasing, managing and marketing large agriculture properties in several western states. During his corporate career, John lived in various Western states where he became familiar with the agriculture and property. Working as a professional real estate broker since 2001, John has bought and sold farms and ranches in many western states and maintains an extensive contact list with real estate related professionals and landowners. At Mason & Morse Ranch Company, John works with a capable team of associates to spread expertise across a wide and varied landscape to serve clients and customers.

John Stratman exclusive listings of ranches for sale across the West.